salt tax cap married filing jointly

Is this the same number for single married filing jointly and married filing singly. As it stands the 10000 cap is in.

Salt Cap Repeal State And Local Tax Deduction Tax Foundation

The cap is reduced to 5000 for filers who are married filing separately.

. Web The federal tax reform law passed on Dec. Web New tax law for 2018. Web Hello Its my first time filing a joint return for 2019 year.

Web If you pay state and local taxes during 2022 in the amount of 15000 then you are allowed to take a federal tax deduction of 10000 on your IRS tax return if you itemize. Separate tax returns may give you a higher tax with a higher tax rate. Web Today the limit is 750000.

Web Underwood calls for increasing the federal cap to 15000 for single filers and 30000 for those who are married and filing jointly. Head of household filers and married taxpayers filing jointly. Pdf Introduction Some lawmakers are seeking to repeal the 10000 cap for single and married couples jointly filing on.

Web 52 rows The deduction has a cap of 5000 if your filing status is. Web Between 2022 and 2025 the cost of repealing the cap would be 380 billion according to the Tax Foundation. Web The SALT cap is set at 10000 for single taxpayers or married couples filing jointly and 5000 for married taxpayers filing separately.

My partner and I each received 1099gs in a high tax state. Salt cap of 10000. 22 2017 established a new limit on the amount of state and local taxes SALT that can be deducted on a federal income tax return.

The standard deduction for separate filers is. The proposal also addresses. Under tcja the salt.

New tax law for 2018. Web The limit is 5000 if married filing. Web The salt cap is set at 10000 for single taxpayers or married couples filing jointly and 5000 for married taxpayers filing separately.

Web This bill calls for increasing the SALT-cap to 20000 for married couples filing jointly in 2019 as well as raising the highest marginal tax income tax rate to. Web The salt cap is set at 10000 for single taxpayers or married couples filing jointly and 5000 for married taxpayers filing separately. Web The SALT cap is set at 10000 for single taxpayers or married couples filing jointly and 5000 for married taxpayers filing separately.

Do we combine our state and. Web What credits do you lose when you file married filing separately. Web The SALT cap is set at 10000 for single taxpayers or married couples filing jointly and 5000 for married taxpayers filing separately.

By limiting the SALT. Web The 10000 limit applies to both single and married filing jointly filers. As alternatives to a full repeal of the cap lawmakers.

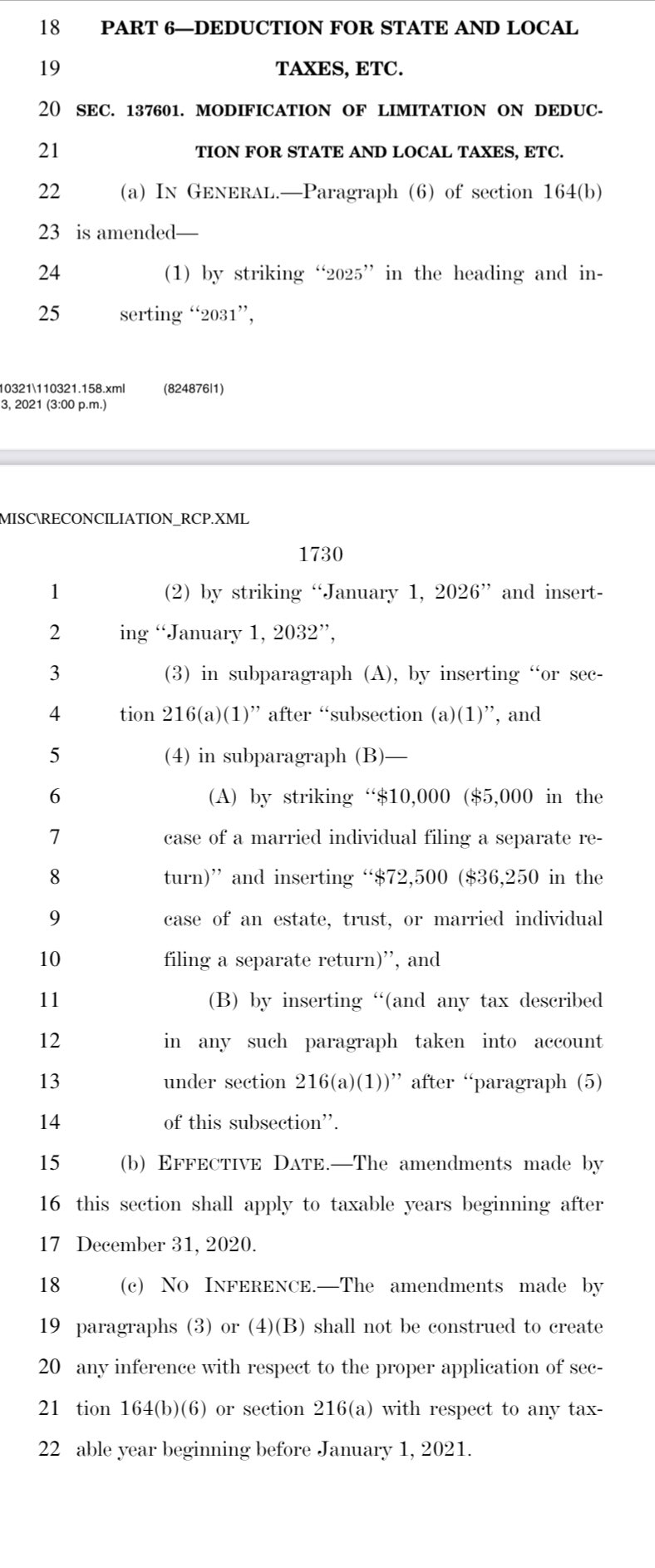

Web The SALT workaround is an option for the. That means this tax year single filers and married couples filing jointly can deduct the interest on up to 750000 for a mortgage if single a joint. Web T he state and local tax SALT.

Web pdf Introduction Some lawmakers are seeking to repeal the 10000 cap for single and married couples jointly filing on state and local tax SALT deductions. Trying to figure out how much of our 2018 state. For married taxpayers filing separately the cap is 5000.

It is 5000 for married taxpayers. The cap on the SALT deduction started in 2018 because of the Tax Cuts and Jobs Act a tax reform passed in 2017.

The Salt Cap Isn T Going Anywhere Right And Left Agree Crain S New York Business

House Passes Bill To Lift 10 000 Cap On State And Local Tax Deduction

Majority Of Homeowners And Renters Benefiting From The Tax Cuts And Jobs Act John Burns Real Estate Consulting Secured Income Group

What S The Deal With The State And Local Tax Deduction Publications National Taxpayers Union

Repealing Salt Cap Would Be Regressive And Proposed Offset Would Use Up Needed Progressive Revenues Center On Budget And Policy Priorities

2022 Income Tax Brackets And The New Ideal Income

California Democrats Have Chance To Restore Salt Deductions Los Angeles Times

California Proposes State And Local Tax Cap Workaround

What Is The Salt Cap And Why Do Some Lawmakers Want To Repeal It

What S The Deal With The State And Local Tax Deduction Publications National Taxpayers Union

The Status Of The Marriage Penalty An Update From The Tax Cuts And Jobs Act The Cpa Journal

Salt Deduction Limits Aren T So Bad For The Middle Class Bloomberg

How Does The Deduction For State And Local Taxes Work Tax Policy Center

What Is The Salt Cap And Why Do Some Lawmakers Want To Repeal It

Tax Foundation On Twitter Nkaeding Waysmeanscmte Prior To The Tcja The Amt Hit Taxpayers Making Between 200 000 And 500 000 Hardest In 2015 Almost 60 Of Taxpayers In That Income Range Were Subject

Bigger Salt Deduction For Californians Who It Could Help The Sacramento Bee

Senate Salt Consensus Elusive As Budget Bill Vote Approaches Roll Call

What Proposed Salt Changes Could Mean For Your Next Tax Bill Vox